On Tuesday 21st February Kameo Recruitment attended Form the Futures annual conference, it was their first in-person conference since 2019, and what an afternoon it was! Our volunteer work with Form the Future underpins our ethos and helps us live by our mission: to build genuine, long-lasting relationships to help people reach their potential.

The turnout on the day was excellent, the takeaways were plentiful and it was very insightful to hear first-hand from the students currently benefitting from Form the Future and the hard work of their volunteers.

⭐ the future generation is fantastic

⭐ the vision for Form the Future is HUGE

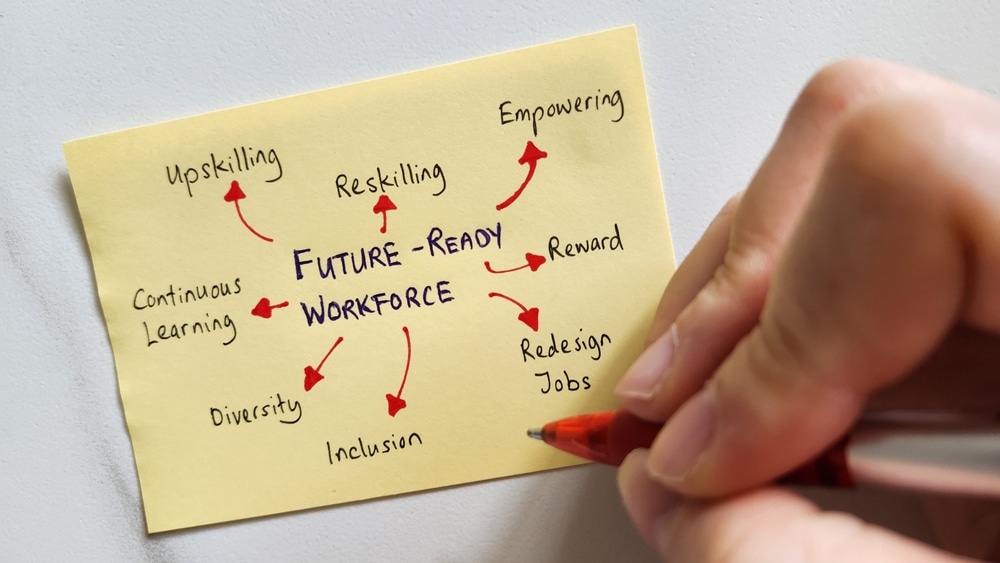

⭐ the world of work will change due to artificial intelligence, we need to be prepared and simultaneously prepare the future world of work for this

⭐ we are only as good as our network & it’s through working together that we make a difference

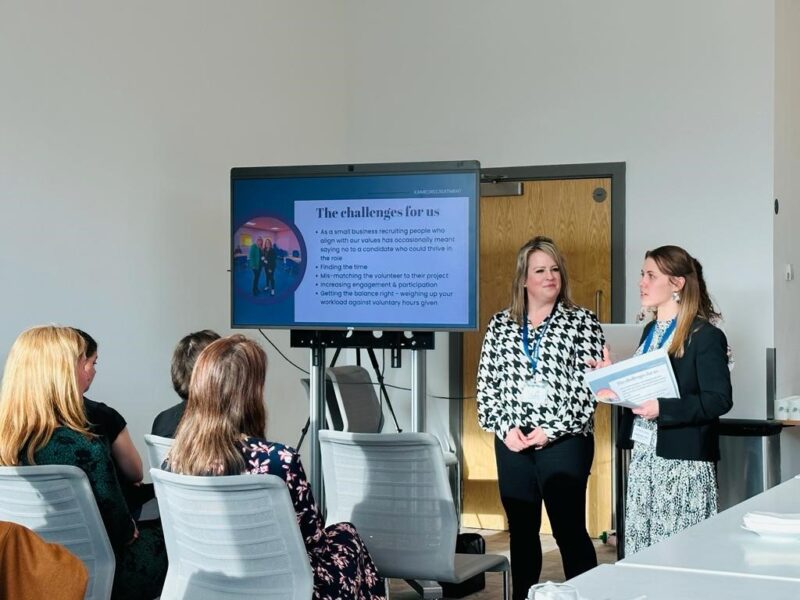

Sharon & Kayleigh were asked to present on “How to Successfully Embed a Volunteering Programme”, it was as a popular workshop, with a high number of attendees, and we’re hopeful several businesses now feel better able to embed a volunteer programme in their business.

Post-event both Sharon & Kayleigh were able to network with like-minded professionals who wholeheartedly believe in the mission and future vision for Form the Future.

➡️To find out further information about Kameo Recruitment’s volunteer work click here.

➡️To find out more about Form the Future, or become a volunteer today click here.